Going full throttle to woo SC and ST voters, chief minister Mayawati on Saturday wrote to Prime Minister Manmohan Singh demanding increase in quota for them as per their population and job reservation in the private sector and the judiciary.Our old friend UDIT Raj has been demanding Reservation in the Private sector and Government response always seemed Positive. Justice Party Man Udit Raj raised the Issue during NDA Government at a time while Disinvestment Ministry was Instrumental for Privatisation. Udit Raj did NOT Oppose Disinvestment or Privatisation rather he tried to mobilise the Excluded Communities in favour of economic Reforms! Mayawati is doing the Same demanding Quota in Private Sector!A day after demanding constitutional amendment for introducing reservation for Muslims in government jobs and educational institutions, UP chief minister Mayawati on Sunday shot off a letter to Prime Minister Manmohan Singh seeking quota for poor members of the upper castes. Just see, how Mayawati Undermines the Constitutional safeguards Ensured by Dr. Ambedkar! BSP supremo Mayawati shot off yet another letter to prime minister Manmohan Singh demanding inclusion of Jats in Central government's list of other backward classes (OBC). This is the third letter to prime minister from Mayawati in three consecutive days. It is the latest modification in her Social Engineering and Casteology!

On the other hand, as Bengali Brahamin Pranab heralded the latest agenda of Mass Destruction and Ethnic cleansing with his Budget commncing the Second Phase of Economic Reforms.The India Incs Government is Implementing Plan B to Push for Reform Drive and Divestment. Hence, the role of Mayawati who is Remote Controlled by the Brahaminical Hegemony, may NOt be judged only as a Electoral Equation of Casteology. It is Deeper Maning as the activities of Uditraj also suggest. Both of them, in fact, Supporting the Cause of Free market Economy and LPG Mafia Rule Manusmriti Apartheid, Justifying the PRIVATISATION!

Full FDI freedom in drug research!

Cabinet approves new mining bill calling for sharing profits, royalties with local communities!

UID tender delay: IT companies like Accenture, HCL Infosystems, Wipro and Mahindra Satyam jittery over vendor selection for Rs 2,000-cr contract

Indian Holocaust My Father`s Life and Time - SEVEN HUNDRED THIRTY FOUR

Palash Biswas

http://indianholocaustmyfatherslifeandtime.blogspot.com/

1 OCT, 2011, 05.17AM IST, ET BUREAU

Rising deficit: Government must do more than a mere delaration

RELATED ARTICLES

- Rs 53000 crore additional borrowing not to impact fiscal deficit: Pranab Mukherjee

- Debt Damage: Government to borrow Rs 53k crore more, shocks debt markets

- Government hikes FY12 borrowing plan by Rs 52,800 cr to Rs 4.7Lk cr

- India surprises with higher borrowing; yields surge

- Petrol prices hiked by Rs 3.14 per litre effective midnight

The government will borrow an extra Rs 52,872 crore from the market this fiscal due to a lower pool of small savings and a dip in its cash balances carried over from the previous year. It is not enough to declare that the government will meet its fiscal deficit target, regardless.

Concrete cuts in expenditure and additional revenue mobilisation must be announced. Of the extra borrowings, Rs 18,000 crore is due to a shortfall in small savings collections. This, in any case, was a government claim on private savings, even if not mediated by banks.

So, the additional, unanticipated demand from the government on private savings is for Rs 35,000 crore. Rightly, the announcement has raised concerns over interest rates hardening and crowding out of private investment. However, given the fragile state of the world economy, India cannot afford to slip on growth. Reforms are needed to maintain growth. One, the government should cut mounting fuel subsidies.

It must implement the decision taken, in principle, to deregulate diesel prices. This would keep fiscal deficit under check and stem inflationary expectations. It would release, for others, a sizeable amount of loans that oil companies secure now from banks to make up for under-recoveries - the difference between the claimed cost price and realised price.

Two, it should allow third parties, such as organised retail players, into oil marketing. An end to cartelisation in oil marketing will compel public sector oil companies to stop padding costs and lower claims on under-recoveries. Three, the government should also push for divestment even if the markets are depressed. Four, the tax base must be widened to raise more resources.

The way ahead is to implement the goods and services tax. With inflation close to double digits, the real returns from small savings are negative. Investors are, instead, betting on gold, an unproductive asset. The government could try to mop up at least the shortfall in small savings through new inflation-indexed bonds.

These could draw in investors in these volatile times. The political leadership must take time out from perpetual crisis management to attend to the needs of the economy.

http://economictimes.indiatimes.com/opinion/rising-deficit-govt-must-do-more-than-a-mere-delaration/articleshow/10191122.cms

Revised disinvestment target in November: Official

Going full throttle to woo SC and ST voters, chief minister Mayawati on Saturday wrote to Prime Minister Manmohan Singh demanding increase in quota for them as per their population and job reservation in the private sector and the judiciary.Our old friend UDIT Raj has been demanding Reservation in the Private sector and Government response always seemed Positive. Justice Party Man Udit Raj raised the Issue during NDA Government at a time while Disinvestment Ministry was Instrumental for Privatisation. Udit Raj did NOT Oppose Disinvestment or Privatisation rather he tried to mobilise the Excluded Communities in favour of economic Reforms! Mayawati is doing the Same demanding Quota in Private Sector!A day after demanding constitutional amendment for introducing reservation for Muslims in government jobs and educational institutions, UP chief minister Mayawati on Sunday shot off a letter to Prime Minister Manmohan Singh seeking quota for poor members of the upper castes. Just see, how Mayawati Undermines the Constitutional safeguards Ensured by Dr. Ambedkar!BSP supremoMayawati shot off yet another letter to prime minister Manmohan Singh demanding inclusion of Jats in Central government's list of other backward classes (OBC). This is the third letter to prime minister from Mayawati in three consecutive days. It is the latest modification in her Social Engineering and Casteology!

On the other hand, as Bengali Brahamin Pranab heralded the latest agenda of Mass Destruction and Ethnic cleansing with his Budget commncing the Second Phase of Economic Reforms.The India Incs Government is Implementing Plan B to Push for Reform Drive and Divestment. Hence, the role of Mayawati who is Remote Controlled by the Brahaminical Hegemony, may NOt be judged only as a Electoral Equation of Casteology. It is Deeper Maning as the activities of Uditraj also suggest. Both of them, in fact, Supporting the Cause of Free market Economy and LPG Mafia Rule Manusmriti Apartheid, Justifying the PRIVATISATION!

-

Revised disinvestment target in November: Official

Zee News - 5 hours ago

"Numbers (of companies which will go ahead with disinvestment) will be cleared ...Steel Authority of India Limited (SAIL) and Rastriya Ispat Nigam Limited ...Government to miss disinvestment target Business Standard

9% growth in 12th plan realistic: Official Hindustan Times

all 15 news articles »

-

PSUs may be asked to buy back government equity: Finance Ministry

Economic Times - 3 days ago

Our aim is to achieve Rs 40000 crore (disinvestment target). ... The stock markets all over the world, including India, have been going through a rough ...Buy back or cross hold? Govt gets market jitters Business Standard

PSUs may be asked to buy back govt equity Rediff

Govt plans to ask cash-surplus PSUs to buyback their shares mydigitalfc.com

all 28 news articles »

-

Fiscal deficit at R2.73 lakh cr in Apr-Aug

Financial Express - 20 hours ago

New Delhi: India's fiscal deficit stood at R2.73 lakh crore during ... R53,000 crore anticipating slower tax collections and lower disinvestment proceeds. ...Deficit surges twofold in Apr-Aug to Rs 2.7 lakh cr Business Standard

all 8 news articles »

-

Coal Ministry asks Neyveli Lignite Corporation to seek board nod ...

Economic Times - 2 days ago

The government has set a disinvestment target of Rs 40000 crore for the current ...It offloaded equity in SJVN, Engineers India, Coal India, Power Grid and ...BOM:513683

-

Finance ministry orders overhaul of government's disinvestment ...

Economic Times - 4 days ago

... India's biggest defence aviation company, and state-owned construction firm NBCC to the front of the disinvestment queue and do bulk sales of equity of ...Govt to put divestment plans on hold: Report Zee News

all 2 news articles »

-

Time to Sell Stakes

Reuters India - Hugo Dixon - Sarah Bailey - 1 day ago

India's rise in borrowing provides perfect excuse to push harder on ... never quite embraced the idea of privatisation, preferring to call it disinvestment. ...

-

Selloff in Ennore Port, Cochin Shipyard, DCI deferred

Times of India - 15 Sep 2011

NEW DELHI: The shipping ministry has deferred its disinvestment plan for Ennore Port, Cochin Shipyard and Dredging Corporation of India (DCI) because of ...Cochin Shipyard, Ennore Port, DCI stake sale not in FY'12 ... Economic Times

all 8 news articles »

-

Government's borrowing target a complete surprise for the markets ...

Economic Times - 1 day ago

Excerpts: ET Now: Are you a bit surprised with the tall claims of Government of India? They have increased the borrowing plan, disinvestment is not ...LON:BARC

-

Government will be able to meet Rs 40000 crore disinvestment goal...

NDTV.com - 13 Sep 2011

It offloaded equity in SJVN, Engineers India, Coal India, Power Grid and Shipping Corporation of India. The government has already approved disinvestment in ...Finmin to review ECB cap later this month Financial Express

all 15 news articles »

-

MoD clears 10 pc disinvestment in HAL

Chandigarh Tribune - 12 Sep 2011

Sources said since HAL is key to Indian Air Force modernisation plans, thedisinvestment will have to be carefully calibrated. ...MoD okays 10 pc divesting in HAL Deccan Herald

Govt may divest 10% in HAL Hindu Business Line

HAL next in line of government's disinvestment framework Military & Aerospace Electronics

all 25 news articles »

Keep up to date with these results:

- Ministry of Finance, Department of Disinvestment

- Disinvestment Policy

- National Investment Fund

- Investor Interface

- Publications

- RTI

- Contact Us

- Useful Links

As on 30 August 2011, the 50 Central Public Sector Enterprises (CPSEs) listed on the stock exchanges contributed about 22% of the total market capitalization.

| Company | Market Capitalisation (Rs.crore) |

| COAL INDIA LTD. | 2,36,832.08 |

| OIL & NATURAL GAS CORP.LTD. | 2,25,137.72 |

| NTPC LTD. | 1,39,801.85 |

| NMDC LTD. | 87,481.46 |

| BHARAT HEAVY ELECTRICALS LTD. | 86,532.45 |

| INDIAN OIL CORP.LTD. | 74,428.88 |

| MMTC LTD. | 69,755.00 |

| GAIL (INDIA) LTD. | 52,083.68 |

| POWER GRID CORP.OF INDIA LTD. | 46,413.00 |

| STEEL AUTHORITY OF INDIA LTD. | 44,567.02 |

- CPSEs constitute 22.11% and 22.58% of the total market capitalisation of companies listed at BSE and NSE respectively (as on 30 August 2011)

- The CPSE with the highest market capitalisation is Coal India Ltd. at Rs.2,36,832 crore (BSE) and Rs. 2,37,243 crore (NSE) (as on 30 September 2011)

- VSNL was the first CPSE to be divested by way of a Public Offer in 1999-00

- ONGC Public Offer in 2003-04 has been the largest CPSE FPO, raising Rs. 10,542 crore

KOLKATA: The central government will come up with a revised disinvestment target and determine the revised number of public sector enterprises whose stake will be divested in the current fiscal in November, a top official said Saturday.

"Numbers (of companies which will go ahead with disinvestment) will be cleared when the revised estimate is prepared. Revised estimate targets are initiated some time around November. I think we will go along with that," Mohammad Haleem Khan, secretary in the disinvestment department (finance ministry), told reporters on the sidelines of a programme organised by the Indian Chamber of Commerce (ICC) here.

Disinvestment plan of the central government for the current financial year has been hit due to uncertainty in the stock market fuelled by global economic slowdown.

The government has raised just Rs.1,145 crore from disinvestment from the first five months of the current fiscal, while the target for the entire fiscal is Rs.40,000 crore.

Khan said the his department was going through the preparations for the divestment in Bharat Heavy Electricals Limited (BHEL), Oil and Natural Gas Corporation (ONGC), Steel Authority of India Limited(SAIL) and Rastriya Ispat Nigam Limited (RINL), among others.

"The department is going through the preparations for all those companies which got authorization from the cabinet. We will keep them in ready condition. When we will feel that it is the right time, we will enter into the market," he said.

He said that BHEL and ONGC were currently ready for disinvestment.

"We will continue to prepare cases for all those companies which fall within the policy," he said.

Khan said disinvestment process in this fiscal differed not only for the current economic scenario, but also for other matters.

"Like some companies are not prepared... they may not have full number of independent directors," he added.

Disinvestment

The disinvestment of Government equity in Central Public Sector Enterprises (CPSEs) began in 1991-1992. Till 1999-2000, it was primarily through sale of minority shares in small lots. From 1999-2000 till 2003-04, the emphasis of disinvestment changed in favour of Strategic Sale viz. sale of a large block of shares along with transfer of management control to a Strategic Partner identified through a process of competitive bidding. After 2004-2005, disinvestment realisations have been through sale of small portions of equity. The total proceeds from disinvestment between 1991-1992 and 31st May, 2008 amounted to Rs.53.423.03 crore, consisting of the following:

| Item | Amount Realised (Rs. In Crore) | Per cent |

|---|---|---|

| Receipts through sale of minority shareholding in CPSEs | 35,358.01 | 66.18 |

| Receipts through sale of majority shareholding of one CPSE to another CPSE | 1317.23 | 2.47 |

| Receipts through Strategic sale | 6,344.35 | 11.88 |

| Receipts from other related transactions | 4,005.17 | 7.50 |

| Receipts from sale of residual shareholding disinvested CPSEs/companies | 6,398.27 | 11.98 |

| Total | 53,423.03 | 100 |

Policy Framework: The National Common Minimum Programme (NCMP) adopted by the Government outlines the policy of the Government with respect to the public sector including disinvestment of Government equity in CPSEs. The salient features of NCMP in this regard are as follows:

- The Government is committed to a strong and effective public sector whose social objectives are met by its commercial functioning. But for this, there is need for selectivity and a strategic focus. The Government is pledged to devolve full managerial and commercial autonomy to successful, profit-making companies operating in a competitive environment. Generally profit-making companies will not be privatised.

- All privatisations will be considered on a transparent and consultative case by-case basis. The Government will retain existing "navratna" companies in the public sector while these companies can raise resources from the capital market. While every effort will be made to modernize and restructure sick public sector companies and revive sick industry, chronically loss-making companies will either be sold-off, or closed, after all workers have got their legitimate dues and compensation. The Government will induct private industry to turn around companies that have potential for revival.

- The Government believes that privatisation should increase competition, not decrease it. It will not support the emergence of any monopoly that only restricts competition. It also believes that there must be a direct link between privatisation and social needs - like, for example, the use of privatisation revenues for designated social sector schemes. Public sector companies and nationalized banks will be encouraged to enter the capital market to raise resources and offer new investment avenues to retail investors.

At present, the Government has decided, in principle, to list, large profitable CPSEs on domestic stock exchanges and to selectively sell small portions of equity in listed, profitable CPSEs, other than the navratnas.

Source: National Portal Content Management Team, Reviewed on: 27-01-2011

| Disinvestment of India�s Public Sector Units L M Bhole, Department of Humanities & Social Sciences | |||

| The role of the State vs. Market has been one of the major issues in development economics and policy. In a mixed economy such as India, historically the public sector had been assigned an important role. However, in the year 1991 the national economic policy underwent a radical transformation. The new policy of liberalization, privatization and globalization de-emphasized the role of the public sector in the nation�s economy. The faculty at IIT-Bombay has been studying various aspects of the New Economic Policy such as financial sector reforms, fiscal implications of reforms, and of globalization. To date several arguments have been proffered by the apologists of market-oriented economic structures:

It is also contended that the functioning of many public sector units (PSUs) has been characterized by low productivity, unsatisfactory quality of goods, excessive manpower utilization, inadequate human resource development and low rate of return on capital. For instance, between 1980 and 2002, the average rate of return on capital employed by PSUs was about 3.4% as against the average cost of borrowing, which was 8.66%. Disinvestment (or divestment) of the PSUs has therefore been offered as one of the solutions in this context. Disinvestment involves the sale of equity and bond capital invested by the government in PSUs. It also implies the sale of government�s loan capital in PSUs through securitization. However, it is the government and not the PSUs who receive money from disinvestment. The fixation of share/bond price is an important aspect of disinvestment. Now, the Disinvestment Commission determines the share/bond price. Disinvested shares are listed, quoted and traded on the stock market. Indian and foreign financial institutions, banks, mutual funds, companies as well as individuals can buy disinvested shares / bonds.......more on next page http://www.ircc.iitb.ac.in/~webadm/update/archives/August_2003/disinvestment1.html |

Disinvestment

Disinvestment, sometimes referred to as divestment, refers to the use of a concerted economic boycott, with specific emphasis on liquidating stock, to pressure a government, industry, or company towards a change in policy, or in the case of governments, even regime change. The term was first used in the 1980s, most commonly in the United States, to refer to the use of a concerted economic boycott designed to pressure the government of South Africa into abolishing its policy of apartheid. The term has also been applied to actions targeting Iran, Sudan, Northern Ireland, Myanmar, and Israel.

Contents[hide] |

[edit]Targets

[edit]Nations

[edit]Iran

Eighteen American states have passed laws requiring the divestment of state pension funds from firms doing business with Iran.[1]

[edit]South Africa

The most frequently-encountered method of "disinvesting" was to persuade state, county and municipal governments to sell their stock in companies which had a presence in South Africa, such shares having been previously placed in the portfolio of the state's, county's or city's pension fund. Several states and localities did pass legislation ordering the sale of such securities, most notably the city of San Francisco. An array of celebrities, including singer Paul Simon, actively supported the cause.

Many conservatives opposed the disinvestment campaign, accusing its advocates of hypocrisy for not also proposing that the same sanctions be leveled on either the Soviet Union or the People's Republic of China. Ronald Reagan, who was the President of the United States during the time the disinvestment movement was at its peak, also opposed it, instead favoring a policy of "constructive engagement" with the Pretoria regime. Some offered as an alternative to disinvestment the so-called "Sullivan Principles", named after Reverend Leon Sullivan, an African-American clergyman who served on the Board of Directors of General Motors. These principles called for corporations doing business in South Africa to adhere to strict standards of non-discrimination in hiring and promotions, so as to set a positive example.

[edit]Northern Ireland

There was also a less well-publicized movement to apply the strategy of disinvestment to Northern Ireland, as some prominent Irish-American politicians sought to have state and local governments sell their stock in companies doing business in that part of the United Kingdom. This movement featured its own counterpart to the Sullivan Principles; known as the "MacBride Principles" (named for Nobel Peace Prize winnerSean MacBride), which called for American and other foreign companies to take the initiative in alleviating alleged discrimination againstRoman Catholics by adopting policies resembling affirmative action. The effort to disinvest in Northern Ireland met with little success, but theUnited States Congress did pass (and then-President Bill Clinton signed) a law requiring American companies with interests there to implement most of the MacBride Principles in 1998.

[edit]Cuba

Though in place long before the term "disinvestment" was coined, the United States embargo against Cuba meets many of the criteria for designation as such — and a provision more closely paralleling the disinvestment strategy aimed at South Africa was added in 1996, when the United States Congress passed the Helms-Burton Act, which penalized owners of foreign businesses which invested in former American firms that had been nationalized by Fidel Castro's government after the Cuban revolution of 1959. The passage of this law was widely seen as a reprisal for an incident in which Cuban military aircraft shot down two private planes flown by Cuban exiles living in Florida, who were searching for Cubans attempting to escape to Miami.

[edit]Sudan

During the late 1990s and early 2000s several Christian groups in North America campaigned for disinvestment from Sudan because of the Muslim-dominated government's long conflict with the breakaway, mostly Christian region of Southern Sudan. One particular target of this campaign was the Canadian oil company, Talisman Energy which eventually left the country, and was supplanted by Chinese investors.[1][2]

There is currently a growing movement to divest from companies that do business with the Sudanese government responsible for genocide in Darfur. Prompted by the State of Illinois - the first government in the U.S.A. to divest - scores of public and private-sector entities are now following suit. In New York City, Councilman Eric Gioia recently introduced a resolution to divest City pension funds from companies doing business with Sudan.

The recent divestment of assets implicated in funding the government of Sudan, in acknowledgment of acts of terrorism and genocideperpetrated in the Darfur conflict. In the United States, this divestment has taken place at the state level (including Illinois, which led the way, followed by New Jersey, Oregon, and Maine). It has also taken place at many North American Universities, notably Cornell University,Harvard University, Case Western Reserve University, Queen's University, Stanford University, Dartmouth College, Amherst College, Yale University, Brown University, the University of California, the University of Pennsylvania, Brandeis University, the University of Colorado,American University, University of Delaware, Emory University, and the University of Vermont. The Sudan Divestment Task Force [3] has organized a nationwide group which advocates a targeted divestment policy, to minimize any negative effects on Sudanese civilians while still placing financial pressure on the government. The so-called 'targeted divestment approach' generally permits investment in Sudan, and is thus radically different from the comprehensive divestment that ended apartheid in South Africa. Because targeted divestment permits investment in hundreds of multinational corporate and private-equity firms that support, lend legitimacy to, and pay taxes and graft to the government of Sudan, policy experts suggest that this "feel good" approach will have little impact on the Sudanese government's sponsorship of terrorism and genocide. Because of the massive deficiencies in the so-called 'targeted divestment approach,' human rights advocates recommend the more comprehensive approach to divestment that has been taken by the State of Illinois.[citation needed] Under this approach, sponsored by State Senator Jacqueline Collins, public pensions are prohibited from investing in any corporation or private equity firm that conducts business in Sudan, unless authorized to do so by the U.S. Government.

[edit]Israel

[edit]Others

Myanmar (formerly Burma) has also been the target of disinvestment campaigns (most notably one initiated by the state of Massachusetts.) Divestment campaigns have also been directed against Saudi Arabia due to allegations of "gender-apartheid." The University of California, Riverside's Hillel chapter has a Saudi Divestment petition circulating as of 2007.

Since 2007, several major international and Canadian oil companies had threatened to withdraw investment from the province of Albertabecause of a proposed increase in royalty rates.[4][5]

[edit]Industries

[edit]Companies

- Talisman Energy - because of its status as the main Western oil company in Sudan in the early 2000s.

[edit]Criticism

Some hold that divestment campaigns are based on a fundamental misunderstanding of how equity markets work. John Silber, former president of Boston University, observed that while boycotting a company's products would actually affect their business, "once a stock issue has been made, the corporation doesn't care whether you sell it, burn it, or anything else, because they've already got all the money they're ever going to get from that stock. So they don't care." [2]

Regarding the more specific case of South Africa, John Silber recalled:

...when the students were protesting the South African situation, I met with them, and they said BU must divest in General Motors and IBM. And I said, "Why should we do that? Is it immoral to own that stock?" Absolutely immoral to own it. And I said, "So then, we're supposed to sell it to somebody? We can't divest unless we sell it to somebody. And if we burn the stock, that just helps General Motors, because it reduces the amount of stock outstanding, so that can't be right. If we sell it to somebody, we have just gotten rid of our guilt in order to impose guilt on somebody else." [2]

The common perception about the effectiveness of divestment lies in the belief that institutional selling of a certain stock lowers its market value. Therefore, the company's networth becomes devalued and the owners of the company may lose substantial paper assets. In addition, institutional divestment may encourage other investors to sell their stocks for fear of lower prices, which in turn lowers prices even further. Finally, lower stock prices limits a corporation's ability to sell a portion of their stocks in order to raise funds to expand the business.

[edit]References

http://www.genocideintervention.net/

[edit]See also

- Economic and political boycotts of Israel

- Ethical consumerism

- Socially responsible investing

- Privatization

UID tender delay: IT companies like Accenture, HCL Infosystems, Wipro and Mahindra Satyam jittery over vendor selection for Rs 2,000-cr contract

BSE

340.70

-02.08%

-07.25

Vol:152656 shares traded

NSE

340.80

-01.95%

-06.80

Vol:1208078 shares traded

Prices|Financials|Company Info|Reports

RELATED ARTICLES

- Identification issues: UIDAI, NPR and the growing list of identifiers

- Cracks appear in Unique Identification Authority of India's enrolment process

- UIDAI ties up with Dept. of Post to expedite enrollment process

- IBM, HP opt out of 2,000-crore UIDAI bid

- HP, IBM: UIDAI tender process unfair

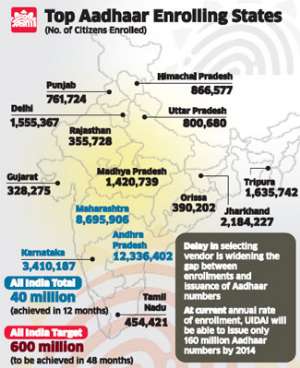

NEW DELHI: IT vendors are becoming jittery as the UIDAI has missed the 90-day deadline to select a vendor for the Rs 2,000-crore citizen database management contract amidst budget cuts from the finance ministry and a clash of a similar tender issued by the Department of IT for a National Population Register.

The delay is widening the gap between enrollments and issuance of Aadhaar numbers. The Unique Identification Authority of India has already enrolled about 40 million citizens but Aadhaar has been issued to only about 33 million people.

The selected vendor will manage IT and data of all Indian citizens, the largest citizen identity database in the world. US-VISIT program run by US department of Homeland Security is the only second such database in the world, which has about 10 million people enrolled in it.

UIDAI will complete its anniversary of issuing its first number on Thursday. At the current annual rate of enrollments, it will be able to issue only 160 million Aadhaar numbers by 2014, unless things are expedited. Accenture, TCS, HCL Infosystems, Wipro,Mahindra Satyam were selected to go in the final round, after IBM and HP opted out of bidding. But the selected vendors are also getting jittery.

"We've invested about $15 million in just preparing the bids. Uncertainty is causing a problem for us and the ecosystem. Ideally the government should sort out UID's clash with other departments," said an e-governance head of a large IT firm. The bids for the most crucial and largest IT tender of about Rs 2,000 crore were put in May, this year by IT companies.

So far, the authority had a record to select vendor in a timeframe of 45 days, from bids to selection. But amidst budget cuts from the centre, the delay is being prolonged. The Ministry of Finance has rejected UIDAI's demand of allocation to be upped from Rs 3,000 crore to Rs 15,000 crore. It has also rejected UIDAI's demand for allowing biometric enrollments over and above the 200 million mark.

The NPR will now take the reins from UIDAI, for enrolling citizens after it achieves 200 million enrollments. It has created a state of limbo for the UID ecosystem, which consists of over 200 empanelled agencies, who are already complaining of a delay in payment from states. An official of a US-based IT firm which pulled out from bids at the last moment said that though its good for their business that duplicate tenders of a similar size and quality are coming out, but it's not good for the taxpayer.

"Ideally the NPR and UID should work together to find a common ground," he added, on condition of anonymity. When ET spoke to UIDAI Director-General RS Sharma on a possible clash with the NPR tender, he said that UIDAI's job is to just implement the policy of the government.

"Our job is to just execute. It's the government which decides on the policies." Due to the government's delay in sanctioning of funds required for the project, the authority has been unable to select a vendor and is thus missing several deadlines in states such as Delhi, in issuing Aadhaar numbers. The Delhi government has extended the deadline to January for covering the whole city.

Check out Brand Equity's Most Trusted Brands List 2011More stories from this edition of UID Cards

- UIDAI chairman Nandan Nilekani defends Aadhaar, to propose Rs 10,000 crore demand

- Aadhaar a valid residence proof for opening bank account:Nandan Nilekani

- UIDAI working under the powers delegated by PM: Nandan Nilekani

- One million people to enroll per day for Aadhaar by October:Nandan Nilekani

http://economictimes.indiatimes.com/tech/ites/uid-tender-delay-it-companies-like-accenture-hcl-infosystems-wipro-and-mahindra-satyam-jittery-over-vendor-selection-for-rs-2000-cr-contract/articleshow/10148944.cms

1 OCT, 2011, 04.27AM IST, ET BUREAU

Fiscal deficit tops 66% of target in just 5 months

RELATED ARTICLES

- April-August fiscal deficit at $55.86 bn: Government

- Rs 53000 crore additional borrowing not to impact fiscal deficit: Pranab Mukherjee

- Need to cut fiscal deficit and make room for private investment: Chief economic adviser Kaushik Basu

- Government confident of not breaching the deficit target

- Finmin confident of keeping fiscal deficit at 4.6% in FY-12

NEW DELHI: India's fiscal deficit during the first five months reached 66.3% of the budgeted estimates, raising fears that the government may overshoot the 4.6% target set for the full year. The deficit for April to August was 2.73 trillion ($56 billion), the Controller General of Accounts said on Friday.

The fiscal deficit-the difference between expenditure and revenue-was substantially lower at 39.7% of the annual target in the same period last year.

The government, however, maintained that it was too early to conclude that the deficit would widen even as it asked all ministries to refrain from seeking money for new schemes other than those that were announced in the budget.

"The numbers are on the higher side but not alarming," said Madan Sabnavis, chief economist,Care Ratings.

The government on Thursday said it will borrow 53,000 crore more from the market. Finance ministerPranab Mukherjee on Friday said "it is too pre-mature to say that there would be adverse impact on fiscal deficit...we have to borrow 53,000 crore to ensure that there is an uninterrupted cash flow". He said as far as fiscal deficit is concerned we shall have to consider various other factors.

The finance ministry has asked all ministries and departments to refrain from seeking funds for non-budget schemes, unless unavoidable, while submitting proposals for the second batch of supplementary demands for grants that will be presented to Parliament in the winter session.

The government has pegged the 2011-12 fiscal deficit at 4.6% of the gross domestic product, lower than last fiscal's 5.1%.

Economists have said that it is too early to predict how the expenditure side would behave as spending tends to be lumpy. So far, there have been no major slippages. Latest figures show that total expenditure was 37.5% of the budgeted amount as compared to 40.4% a year earlier.

DK Joshi, chief economist Crisil, said: "There seems to be some fiscal pressure in the system and expenditure trends cannot be seen as a pointer to the future."

Historically, revenue and expenditure trends have shown that the government usually spends more in the first half while revenues pick up in the latter half.

The RBI had earlier said that fiscal consolidation was also needed to control inflation and that monetary measures alone would not be sufficient.

Experts say that achieving the fiscal target of 4.6% would be difficult as the slowdown would affect revenues. Revenue receipts have been much lower at 23.9% of the budgeted estimates compared to 42.6% last year.

Check out Brand Equity's Most Trusted Brands List 2011

http://economictimes.indiatimes.com/news/economy/finance/fiscal-deficit-tops-66-of-target-in-just-5-months/articleshow/10190836.cms

30 SEP, 2011, 05.06AM IST, ET BUREAU

2-3% interest relief for exporters likely

RELATED ARTICLES

- Exporters to get Diwali gift; interest subsidy on cards

- Encash dollar earnings without being greedy: Government to exporters

- Govt may restore interest subsidy for exporters

- Talks on stimulus package for exporters gain ground as August export rises only 44.2%

- Exports up 44.2 per cent in August; deficit widens to $14.1 bn

NEW DELHI: Acting early to shield exporters from an impending slump in global demand, the government has decided to announce a host of sops, including aninterest subsidy scheme for select sectors in a month.

"After the sectoral reviews, we will be announcing the incentives. You can definitely expect it by the end of October or first week of November," commerce and industry minister Anand Sharma told reporters after the meeting of an industry-government task force.

The minister said that the export target of $ 300 billion for the year was on track, but concerns over global slump were real and diversification into new markets was the only way forward for ensuring growth over the coming months.

S harma said the finance ministry has agreed to an interest subvention scheme for export credit and theReserve Bank of India is expected to notifiy it soon. While the minister did not reveal what the subsidy level would be, some officials said it could be between 2% and 3%. The RBI raised key interest rates by 25 basis points last week for the 12th time since March, 2010.

Exports in April-August 2011 posted a sharp growth of 54.21% to $134.5 billion, but Commerce Secretary Rahul Khullar had pointed out while announcing trade figures earlier this month that growth had started tapering. Khullar said growth would start declining in September-October as the weakness in the US and he Eurozone would shrink total demand.

We have to act before the slowdown kicks in, he said.

The government may carry out a re-jig in sops by offering it for products that need support and incentivising export to new markets.

On foreign direct investment, or FDI, in pharmaceutical industry, the minister informed the task force that the Prime Minister will convene an inter-ministerial meeting soon to deliberate on whether FDI in the sector should continue on the automatic route even for brown field investments or it should be placed under the government approval route.

"While we recognize that the pharmaceutical industry, like any other segment, undergoes the transformation and consolidation, yet the indigenous capacities of research and production of medicines need to be preserved and nurtured," he added.

"India needs more than a trillion dollar investment in infrastructure in the next 5 years. DMIC - a project entailing an investment of $90 billion- would be a major component of it", said Chandrajit Banerjee, Director General, CII, who also attended the meeting.

On the stalled National Manufacturing Policy, the minister said that minor issues remain and the group of ministers (GoM) headed by Sharad Pawar will soon attempt to resolve them.

http://economictimes.indiatimes.com/news/economy/foreign-trade/2-3-interest-relief-for-exporters-likely/articleshow/10177788.cms

Just see:

| Full FDI freedom in drug research | |

| OUR SPECIAL CORRESPONDENT | |

New Delhi, Sept. 30: The government today allowed 100 per cent FDI under the automatic route in industrial parks for bio-tech and pharmaceutical research. This was one among a raft of proposals to ease foreign investment norms that were announced today. Overseas investors can now enjoy greater freedom in segments ranging from external commercial borrowings and FM radio to apiculture (bee keeping), educational institutes and NRI accounts. Every six months, the government updates the FDI policy document, a ready reckoner for foreigners. A government circular said the 100 per cent FDI in bio-technology, pharmaceutical and life sciences was necessary "given the urgent need to augment research and development infrastructure in these areas as also expand the production facilities". In ECBs, the government has allowed an issuer to pledge its shares, widening the options for raising resources. The government also allowed 100 per cent FDI for apiculture (beekeeping) as it is an important agro-based industry and has potential to bring high returns. "Liberalisation would not only provide the desired thrust to the sector but would also bring in international best practices to upgrade the product and the methods of production," the circular said. FDI limit in FM radio is now up to 26 per cent, bringing it on a par with print. There will also be an e-auction of 839 FM stations in 294 towns, in a manner similar to the auction of 3G telecom spectrum. Analysts estimate the e-auctions can fetch Rs 17,000 crore, which is 10 times the revenues earned five years ago from the second round of FM auctions. Restrictions in the FDI policy related to construction have been eased for educational institutions and old-age homes. Investments in construction development sector have restrictions of minimum area and built-up area requirements, minimum capitalisation requirement and lock-in periods. The policy provides for opening and maintaining, without RBI approval, non-interest bearing rupee escrow accounts by non-residents towards payment of share purchase. FDI from April to July went up 92 per cent to $14.54 billion from $7.56 billion in the corresponding period in the preceding year. For the first six months of 2011, FDI showed an increase of 57 per cent to $16.83 billion. |

http://www.telegraphindia.com/1111001/jsp/business/story_14575832.jsp

Cabinet approves new mining bill calling for sharing profits, royalties with local communities

Cabinet has approved a bill calling for mining firms to share either profits or amounts equivalent to royalties, a move that could boost political support for the government and free up lucrative projects but also raise business costs.

The bill, which must now win parliamentary approval, calls on coal miners to share a maximum 26 percent of their profits with local communities and for other miners an amount equivalent to royalties, government ministers said on Friday.

The initial proposal suggested all miners give 26 percent of profits to local communities.

"All coal mining companies have to share 26 percent of their profits," Coal Minister Sriprakash Jaiswal told reporters after a cabinet meeting.

The draft law proposes the profit sharing formula in a bid to smooth land acquisition, a touchy issue in the country, where many oppose natural resources being carted away by outsiders.

A part of government moves to expand social programmes for the poor, the bill seeks to simultaneously please the core support base, block flows of new recruits to a Maoist insurgency and balance modern lifestyles against traditional ways.

While industry bodies are reconciled to sharing some profits, they have baulked at 26 percent, saying that will raise business costs too much and deter investors.

Shares of Coal India , the world's biggest coal miner, fell 3.4 percent after the cabinet approved the bill.

The mining ministry says that profit-sharing should make it easier for mining projects to win local approval and accelerate the pace of developments.

Years of protests, sometimes violent, have delayed many industrial projects, including South Korean steel maker POSCO's plant in Orissa state, the biggest foreign direct investment in India at $12 billion.

County's mining sector has only opened up fully to private investors in recent years and state-run companies have lacked the funds and expertise to probe deeper than the top 50 metres or so where its iron ore and coal reserves are found.

The bill is likely to be presented in the session of parliament in December and approved, though the opposition could seek changes.

Prabudh Nagar, Bhim Nagar and Panchsheel Nagar will be the three new districts of Uttar Pradesh. Chief minister Mayawati made an announcement about the formation of these districts on Wednesday. The step has been taken to provide better administration, she said after touring the three districts to start her election campaign. With this, UP now has 75 districts. In a swift move, the state government also posted the district magistrates and police chiefs in the new districts.

Announcing the formation of Hapur as a district, Mayawati said the new district - Panchsheel Nagar - will be carved out of the existing Ghaziabad. Consisting of the existing Hapur and Garhmukteshwar tehsils of Ghaziabad, the district will comprise a third tehsil, Dhaulana, which has been formed for inclusion in the new district. With a population of 14.22 lakh, the headquarters of Panchsheel Nagar will be at Hapur.

Dalit leader to give his own version of Lokpal to Parliament committee

Published: Tuesday, Sep 20, 2011, 19:24 ISTPlace: New Delhi | Agency: PTI

Dalit leader Udit Raj, who is campaigning against Team Anna's version of Lokpal bill, Tuesday demanded that corporates, NGOs and media are brought under the anti-corruption ombudsman to make the law "more effective".

"If there is no representation of plurality, I don't think this law will be successful," the National Chairman of All India Confederation of SC/ST Organisations said.

He said he along with other activists will give their own version -- the'Bahujan Lokpal Bill'-- to the Standing Committee on September 24.

The Bahujan Lokpal Bill claims to have taken up issues that are not mentioned in the existing three drafts--government draft, Jan Lokpal bill and Aruna Roy's bill, he claimed.

Raj said their drafting group consists of 16 core members including representatives from Muslims, Christians, Dalits, other backward classes(OBC) and progressive Brahmans.

"Anna Team has given the impression that the backward, dalits and minorities are ignored and their civil society, indeed, does not represent them. These sections are apprehensive that if they are not given representation in the Lokpal committee, their victimisation is sure," he said.

The group alleged that corporate houses "are dens of corruption" and should also be brought under the ambit of Lokpal, if corruption is to be fought seriously.

NGOs and Media should also not be left out, Raj added.

Disagreeing with Arwind Kejriwal's view on excluding NGOs from Lokpal Bill because there are separate laws to govern them, Raj said that there are similar laws for politicians and judiciary too.

He said they would protest if corporates and NGOs are not brought into Lokpal's ambit.

http://www.dnaindia.com/india/report_dalit-leader-to-give-his-own-version-of-lokpal-to-parliament-committee_1589531

-

Udit Raj - Wikipedia, the free encyclopedia

- en.wikipedia.org/wiki/Udit_Raj

- From Wikipedia, the free encyclopedia. Jump to: navigation, search. Udit Raj (born Ram Raj on 1 January 1958) was born in Ramnagar, Uttar Pradesh into a low ...

- Activism - Controversies - See also - References

-

Dalit Freedom Network // About Us // Dr. Udit Raj

- www.dalitnetwork.org/go?/dfn/about/C189/

- Dr. Udit Raj (Ram Raj) is the National President of the Justice Party, the Confederation of Scheduled Caste/Scheduled Tribe Organizations, and the Lord ...

-

Articles about Udit Raj - Times Of India

- articles.timesofindia.indiatimes.com › Collections

- Udit Raj News. Find breaking news, commentary, and archival information about Udit Raj From The Times Of India.

-

Buddha Education - Dr. Udit Raj

- www.buddhaeducation.org/link_1.html

- Dr.Udit Raj was born into a Dalit Hindu family of Allahabad District in the state of Uttar Pradesh. He was originally Ram Raj and studied in an Uttar Pradesh ...

-

Images for Udit Raj

- - Report images

-

Dalit leader Udit Raj forms anti-Maya platform in UP - Hindustan Times

- www.hindustantimes.com/Dalit...Udit-Raj.../Article1-688128.aspx

- 21 Apr 2011 – With Uttar Pradesh (UP) elections approaching, there are distinct signs of an attempt from within Dalits to break Mayawati's vote bank.

-

Udit Raj | Facebook

- www.facebook.com/udit.raj3

- Join Facebook to connect with Udit Raj and others you may know. Facebook gives people the power to share and makes the world more open and connected.

-

Udit Raj: Latest News, Photos and Videos

- connect.in.com/udit-raj/profile-277021.html

- Explore Profile of Udit Raj at Connect.in.com, see Udit Raj web of connections, news, videos, photos and post your opinions.

-

Dr. Udit Raj to Meet Prime Minister of India | All India Confederation ...

- scstconfederation.net/?p=135

- 2 Sep 2011 – Dr. Uditraj, Chairman of All India Confederation of SC/ST Organization along with the eminent leaders of Dalit/ST/SC/OBC/ Minorities and ...

-

Reservation For Dalits In Private Sector By Dr. Udit Raj

- www.countercurrents.org/dalit-uditraj220604.htm

- Reservation For Dalits In Private Sector. By Dr. Udit Raj. 22 June, 2004. Countercurrents.org. The reservation in private sector is the talk of town. There are ...

-

Pasmanda Muslim Forum: An Open Letter to Dr. Udit Raj

- www.pasmandamuslims.com/2011/06/open-letter-to-dr-udit-raj.html

- 6 Jun 2011 – This is a response to Dr. Udit Raj's (President, Indian Justice Party) note "Rather Upper Castes are nearer to Muslim than Dalits (untouchables)" ...

It was much more than the magical formula of Dalit-Muslim-Brahmin that earned BSP supremoMayawatithe landslide victory in the 2007 Uttar Pradesh assembly polls. Behind Behenji's winning social engineering concept was the might of over 132criminal warlordsfrom the UP ganglands, who were handpicked by the BSP to represent it before the people.

The ploy worked with the electorate sending 70 of them to the assembly and givingMayawatione of her best wins in the UP polls. Many of them were rewarded with cabinet berths and top posts at state bodies. But the honeymoon did not last long and soon the strongmen or Bahubalis - as they are called in the local dialect - started giving Mayawati headache.

The complete disregard for law and power proved to be a lethal combination, which was exemplified in severalMLAsindulging in brazen acts of violation of the law. Mayawati responded by cracking the whip.

On an operation whitewash before the assembly polls - scheduled early next year - the BSP supremo has weeded out more than a dozen of her ministers, MPs and MLAs in the last one year. The action was backed by a very politically correct logic - unlike her bete noire Mulayam Singh Yadav, Mayawati didn't tolerate criminals in her ranks.

She has removed five senior members of her party in the past couple of days. On Thursday, Bikapur (Faizabad) MLA Jitendra Singh Babloo joined the Peace Party, saying he deserted the BSP minutes before he was supposed to be suspended by the BSP supremo. Interestingly, state BSP chief Swami Prasad Maurya cited Babloo's criminal activities as the reason behind his suspension.

Babloo is the same legislator who was given a clean chit by Mayawati when UP Congress president Rita Bhuguna-Joshi had accused him for the incendiary attack on her Lucknow residence on July 15, 2009.

Four days ago, Maya suspended controversial Meerut MLA Haji Yaqub Qureishi for making derogatory remarks against the Sikh community. Qureishi has over a dozen cases of criminal assault and rioting against him. He had hit the international headlines in February 17, 2006, by announcing during a Friday prayer in Meerut a reward of Rs 51 crore on the head of the Danish cartoonist who made a caricature of Prophet Mohammad. He was the then minorities welfare minister in the Samajwadi Party (SP) government.

THISweek, she removed Yogendra Sagar - party MLA from Bilsi in Badaun. He was accused of abducting and raping a girl and then implicating her brother in a false case of kidnapping to mount pressure on her parents to withdraw the case against him. A local court had declared Sagar an absconder last year. But while juggling her cards wisely, Mayawati suspended him just before the assembly elections.

She also suspended Jaunpur MP of the party, Dhananjay Singh, on September 22 when he went to see ailing Rajya Sabha member Amar Singh in AIIMS. For the record, the MP is a mafiaturned- politician whose shooters in prison had allegedly eliminated deputy CMO of family welfare department Dr Y.S. Sachan in the Lucknow district jail in June this year.

But the "poll stunt" failed to impress Malti, Sachan's wife. "My husband was killed because he was about to reveal the involvement of Babu Singh Kushwaha and Anant Kumar Mishra in the multi-croreNRHM scam. God and the people are watching these things and the guilty will be punished," she said.

Contrary to Malti's impassioned plea, Maya's calculation has no emotion. BSP sources said she has asked senior members of her government to assess the benefits the BSP could reap if Kushwaha and Mishra were suspended from the party before assembly elections.

Dhananjay's suspension also reveals the politics of convenience that Mayawati has been pursuing. The BSP supremo had herself inducted a known Amar aide,Samajwadi PartyMLA Ashok Chandel, and later suspended him on September 21 for anti-party activities. Chandel, too, is a known name in the crime circles of Bundelkhand.

EARLYthis month, Mayawati had suspended animal husbandry and dairy development minister Awadh Pal Singh after UP Lokayukta justice N.K. Mehrotra found him guilty of a multicrore scam in the veterinary department in Etah.

Mayawati has recently suspended another rogue minister Rajesh Tripathi on the basis of a Lokayukta report that indicted him in a land grabbing case in Gorakhpur. While 13 leaders have been suspended in the past one year, the UP chief minister suspended Shekhar Tiwari, who was involved in the murder of PWD executive engineer Manoj Kumar Gupta, in 2009. He is in jail.

S.R. Darapuri, former UP IG, said: "People had dethroned Mulayam Singh Yadav because rogue SP members were openly defying law and order. It is strange that people were expecting Mayawati to get them rid of goons but they did not mind electing criminals again."

Read more at:http://indiatoday.intoday.in/story/up-polls-2012-mayawati-carcks-whip-on-criminal-politicians/1/153307.html

Read more at:http://indiatoday.intoday.in/story/up-polls-2012-mayawati-carcks-whip-on-criminal-politicians/1/153307.html

UP chief minister Mayawati shot off yet another letter, seventh in last 10 days, toprime minister Manmohan Singh on Saturday. This time she has demanded increase in the percentage of reservation provided to Scheduled Castes and Scheduled Tribes (SC/ST) in view of increase in their population and introduce quota system in the judiciary, private sector and other places where it has not been implemented as yet.Times of Indai reports.

Earlier, she had written to the prime minister for providing reservation to Jats under other backward class (OBC) category, upper caste poor on financial basis, quota within quota in OBC category to backward Muslims, inclusion of 25 most backward classes (MBC), dalit Muslims and dalit Christians in the SC/ST category, pathetic condition of national highways in UP and shortage of fertilisers. The letters are being seen as BSP chief's move to play caste card before 2012 assembly elections. Mayawati has sought to appease all sections of society -- backwards, dalits, upper castes and Muslims. She is also looking forward for an alliance of dalit-Brahmin-Muslim-MBC for 2012 elections. BSP had come to power with absolute majority in 2007 with the support of dalits and by successfully wooing a section of Brahims, Muslims and MBCs.

In her letter, Mayawati has stated that the population of dalits and tribals have increased considerably since Independence, hence it is important to increase the percentage of reservation to dalits and tribals in government jobs and educational institutions. She reiterated inclusion of MBCs in SC/ST list and providing them a fixed quota within quota. She had suggested that after including MBCs, dalit Christians and dalit Muslims in the SC/ST category, the percentage of quota should also be increased in accordance with the increase in number of communities. She had even recommended amendment in the constitution to increase quota and to include more castes and classes for reservation benefit. She had demanded that the reservation policy should be put in the ninth schedule of the constitution so that it cannot be challenged in any court of law.

Arguing that increase in quota will help marginalised sections to join national mainstream, Mayawati also patted her back for initiating number of schemes to benefit downtrodden in UP. The BSP government has introduced quota for dalits in allotment of government contracts upto Rs 25 lakh, reservation facility in promotions, filling of backlog reserved category vacancies, 10% quota in jobs in private sector units established with the help of state government and quota in jobs for dalits in the services outsourced to the private sector. Mayawati has also decided to introduce 23% quota to SC/ST and 27% for OBCs in the industrial units established under public-private-partnership. Besides, the government has also implemented several schemes - free housing for urban poor and dalits, scholarships for dalits, backwards and Muslims among other things.

Incidentally, Mayawati appointed 1977 batch IPS officer Brij Lal, a dalit, as the new director general of police (DGP) of UP on Saturday following superannuation of RK Tiwari, a Brahmin. Tiwari was made DGP last month after retirement of Karamveer Singh. Tiwari remained DGP for around a month. Political analysts say that Mayawati has tried to give a message to both Brahmins and Dalits with appointments of Tiwari and Lal. Significantly, Lal was already handling several important police departments. A judicial magistrate in Ghaziabad had recently directed police to lodge an FIR against Lal and some other senior IPS officers on the petition of a police constable Brijendra Singh Yadav who alleged that Rs 25 per month were illegally deducted from the salaries of 3.5 lakh constables in UP. Lal has challenged the order in the High Court.

http://timesofindia.indiatimes.com/india/Mayawati-wants-dalit-quota-in-judiciary-and-private-sector/articleshow/10197095.cms

Mayawati also requested the PM to incorporate the reservation policy in the Ninth Schedule of the Constitution to ensure it is not challenged legally. She said reservation was necessary to help those living below the poverty line, irrespective of their caste and class, and demanded that the backlog of vacancies in reserved category be filled urgently.

Reservation should be implemented in private sector and other government or semi-government services as well, Mayawati added.

Maya's Sunday letter is being seen as an effort to strike a balance in her 'Sarvjan vote bank' which comprises Dalits, Muslims, Brahmins and most backward classes. The CM reminded the prime minister that she had raised the issue of quota for upper castes on financial grounds in 2007 as well, soon after coming to power. She had also requested Singh to sanction financial packages for UP's backward regions.

Muslim are 20% of UP's population and upper castes comprise around 12%. While Muslims can tilt the balance in one-third of 403 assembly seats, upper castes are crucial in around 100 seats. Brahmins can make a difference in around 60 seats. Maya had successfully wooed a section of Brahmins in 2007 by demanding 10% quota for poor upper castes.

SP leader Ahmad Hasan accused Mayawati of not fulfilling any promise she had made in July 2007 in a meeting with Muslim ulema. Although the opposition criticised Mayawati, all political parties barring the BJP support Muslim quota as recommended by the Sachar Committee andRangnath Commission. Union law minister Salman Khurshid is said to be preparing a legislation for Muslim reservation.

The Samajwadi Party has already demanded quota for Muslims. Muslim organisations have welcomed Maya's demand saying reservation for socially and financially backward Muslims should be implemented at the earliest. "Some Muslim communities have been included in the other backward class (OBC) category list in UP for reservation benefit but we want a definite quota within 27% quota for OBCs," said All India Muslim Personal Law Board member Zafaryab Jilani.

http://timesofindia.indiatimes.com/india/Now-Mayawati-demands-quota-for-poor-in-upper-castes/articleshow/10033858.cms

While in the first letter she asked for constitutional amendment for Muslim quota in government jobs and educational institutions, the second one was for giving reservation to poor upper castes and putting reservation policy in ninth schedule of the constitution so that it cannot be challenged in any law court.

Maya has written that Jats earn their livelihood from agriculture and related activities. However, with time and increase of population, the per person land holding has dropped. As a result, Jats are now financially and educationally backward.

"The Jats in UP were included in OBC list in March 10, 2000. The Jats (leaving those living in Dhaulpur and Bharatpur districts) in Rajasthan were included in the Centre's OBC list in October 1999. The financial and educational condition of Jats in UP is similar to their counterparts in Rajasthan. Hence, the Jats of UP should be included in the government of India's list of OBC," she has written. Jats are the largest ethnic group having presence in Hindus, Muslims and Sikhs in India.

Their population is believed to be around 8.25 crore across nine states in India. In UP, their population is around 1.75 crore. Jats are only 5-6% of the total population of UP but they constitute 17% of the populace in the west UP and can affect elections in 55 assembly constituencies and 10 Lok Sabha constituencies. Besides UP and Rajasthan, Jats are already getting reservation under OBC category in Himachal Pradesh, Gujrat, Uttrakhand, Bihar and Delhi. However, Haryana, Punjab, Jammu & Kashmir and Maharashtra have not included Jats in OBC list. Yashpal Malik, president, All India Jat Arakshan Samiti, welcomed Mayawati's move.

"Central government had promised us in March 27, 2011, that Jats will be included in the Central OBC list within a month but we are still waiting for result," said Malik, who led the 21-day agitation in March blocking rail and road routes from Delhi to UP and beyond. The samiti will launch its agitation again if demand is not met by November after conducting a series of rallies in UP and other states from October 1 onwards, he added. On Saturday, Mayawati had written to prime minister for providing quota to Muslims by bringing them under the reservation policy. She had stated that her party will support the central government if quota for Muslims requires constitutional amendment. On Saturday, she wrote to Manmohan Singh for granting reservation to upper castes living under below poverty line.

With three letters Mayawati has tried to strike balance between minorities, OBCs and upper castes with 2012 assembly elections in mind. While muslims constitute around 18% of the electorate in UP, upper castes are around 20% (10% Brahmins 7.5% thakurs and 3% others, OBCs around 40% and dalits around 21.5%. Of total upper castes, 12% are said to be living under below poverty line. In UP's OBC list, there are total 79 classes/castes which include 34 muslim communities.? ?Reacting to Maya's letter, BJP spokesperson HN Dixit said that it was BJP government in 2000 under Rajnath Singh which granted Jats status of OBC in UP.

Singh, he said, had also introduced quota within quota for OBC for most backward classes which included 33 muslim communities. However, in 2002, Mayawati government scrapped the provision, thus reduced the benefits of muslim OBCs.

http://timesofindia.indiatimes.com/city/lucknow/Mayawati-now-wants-reservation-for-Jats/articleshow/10042093.cms

Maya mantra to win polls

TNN | Mar 5, 2011, 05.30AM ISTLUCKNOW: The month-long statewide inspection drive to assess the progress of developmental projects and implementation of various schemes by chief minister Mayawati was not only an administrative exercise. If sources are to be believed, the drive in fact is part of her five point strategy to romp home in the 2012 UP assembly polls.

During her visits, Mayawati also took feedback of the performance of sitting MLAs and the candidates short-listed for the 2012 assembly polls before making final announcement.

The Ambedkar villages selected for visit also had substantial Muslim population, sources said and added that she has already constituted bhaichara (brotherhood) committees at the booth level in districts to bring castes and communities other than dalits, close to the BSP. Party insiders also said that the BSP supremo is aiming to build an alliance of dalit, most backward classes and Muslims without upsetting the upper castes, particularly the Brahmins.According to sources, Maya has chalked out a five point programme for her mission 2012.

First: If in 2007 BSP's focus was on dalit-brahmin-muslim alliance, which brought it to power with absolute majority, for 2012, the party is aiming at the combination of dalit-muslims-most backward classes. At the same time, BSP will not say or do anything, which could antagonise any caste or community.

Secondly, Maya wants to declare party candidates one year in advance for polls due in April-May 2012, so that the latter get enough time to groom their constituencies.

Maya is of the view that a candidate should not be barred from contesting election on the basis of criminal record, but party sources said that she is taking extra care to verify credentials of the candidates selected for 2012 assembly elections before announcing their names. "Recent accusations of rape and murder against some BSP leaders has hit party image and Behenji does not want more controversies. We won 2007 election on law and order issue, hence extra care is being taken to improve the situation," said a senior BSP leader.

The third point in Maya's agenda is to find out a detailed caste configurations of every constituency, as delimitation has changed the demographic profile and old equations in comparison to 2007 assembly elections.

Maya wants all development work sanctioned for dalit dominated areas to be completed by July this year to counter Congress's attempt to poach on her dalit vote bank. Committed dalit leaders have been given important positions at district level in party organisation and have been told to convince dalits that the BSP is the only party they can trust on.

PWD minister Naseemuddin Siddiqui, has been asked to build an alliance of Muslim-dalit-backward classes to score in 89 reserved assembly seats in the state out of 403 assembly constituencies. Maya's close confidant and Brahmin face of the party, SC Mishra will continue to focus on the Brahmins. Swami Prasad Maurya and backward leader Babu Singh Kushwaha are working among non-Yadav backward classes and most backward classes (MBCs) close to the BSP.

http://timesofindia.indiatimes.com/city/lucknow/Maya-mantra-to-win-polls/articleshow/7631895.cms

Mayawati does a seasonal party clean-up

Cancels tickets of over two dozen MLAs, goes the extra mile to project herself as an able administrator, but many skeletons remain in the closet

Samarth Saran

New Delhi

|

With the Assembly poll drawing closer in Uttar Pradesh, Chief Minister Mayawati is on a cleaning spree. She has in recent times either suspended or expelled more than a dozen sitting Members of the Legislative Assembly who were facing criminal charges against them, from her party. Interestingly, some of the MLAs and party leaders are those ones against whom the Mayawati-government had once requested that criminal cases be withdrawn against them.

Political observers describe this move by Mayawati as shrewd move to portray herself as a clean administrator. "What is done during the last six to eight months of the government have more of an impact on the voters. This move by Mayawati will certainly help in boosting her image," says Sanjay Kumar of Centre for the Study of Developing Studies (CSDS).

Mayawati's tenure has been rocked by the murder of chief medical officer Dr BP Singh in and the Banda Rape case. Even though tough measure have been taken by her in the case, Uttar Pradesh Congress Committee president Rita Joshi says that the these step are too late and too little. "Her image has taken a beating and Mayawati has emerged as one of the worst administrators in maintaining law and order in the state" says Joshi.

A case in point is Dhananjay Singh, the party MP from Jaunpur, who was suspended recently for indiscipline, was once the party favourite. Two cases against him under the Uttar Pradesh Gangster Act were withdrawn by the Government in 2008. In fact Singh's father Rajdev Singh a sitting MLA, has also been denied the ticket from Rari in Jaunpur.

Then there is Jitendra Singh Babloo, an MLA from Bikapur, who has a dozen criminal cases against him including one of setting Rita Joshi's residence on fire. A case of extortion and criminal intimidation against him was withdrawn in 2008 after a request from the Mayawati government. He too he has now been suspended from the party and denied a ticket. Former Medical Health Minister Anant Kumar Mishra who resigned after the murder of CMO Dr BP Singh, has also been denied a ticket. Other ministers who have been denied tickets are Avadh Pal Singh Yadav, Badshah Singh and Subash Pandey.

Yadav, who was the former animal husbandry and dairy development minister had resigned after being indicted by the Lokayukta, and was suspended on disciplinary grounds. Sitting BSP legislators who have been denied tickets include Jitendra Singh Babloo, Sonu Singh, Sushil Singh and Anand Sen Yadav.

Sources say the BSP chief is going over the candidates' list again and those with a criminal background might be denied tickets even if their names have already been declared. The CM might walk the extra mile to project herself as an able administrator, but a cursory glance over the list of sitting MLAs or MPs depicts a different picture. Shahnawaz Rana for example, an MLA from Bijnore, he was suspended from the party after his aide tried to rape two tourists at gunpoint in Muzaffarnagar. However, Mayawati had ordered the withdrawal of criminal cases against him and his uncle Kadir Rana who is an MP from Muzaffarnagar.

These cases were lodged against them for indulging in e arson and violence during the 2004 Lok Sabha elections. The government had requested that cases be withdrawn in public interest. The court had rejected the application. Apparently, the government has also moved applications for criminal cases to be withdrawn against a dozen MLAs.

Samarth Saran is a Correspondent with Tehelka.com.

samarth@tehelka.com

http://www.tehelka.com/story_main50.asp?filename=Ws011011Utttar_Pradesh.asp

Name game and its after-effects

Swati Mathur, TNN | Oct 1, 2011, 12.03PM ISTLUCKNOW: Districthood may mean smaller administrative units, but it hasn't translated into an easier life for most. Take Sant Ravidas Nagar, erstwhile Bhadohi, for instance. Created on June 1994 as the 65th district of the state, the district has still not shed its Bhadohi tag, even after 17 years of being renamed by chief ninister Mayawati, during her first stint at the top.

A hub for manufacturing and exporting 75% of India's total carpets, the region is still recognised as Bhadohi, rather than Sant Ravidas Nagar. What is interesting is that the state government, despite its decision in this regard, continues to play along. "For ease of use, our passports bear the name of Sant Ravi Das Nagar Bhadohi. The passport office in Lucknow, from where our applications are processed, accepts this format. With Bhadohi as part of the name, it is not difficult to travel,'' said ON Mishra, a carpet manufacturer and exporter from the region.

Sant Ravidas Nagar, in fact, is not the only district to suffer this fate. Of all the districts Mayawati has created or renamed, Mahamaya Nagar, erstwhile Hathras, has the most curious history. Till 1997, Hathras was but an ordinary town famous for its culture and literature. The district had its first brush with an identity crisis when Mayawati took over as UP chief minister renamed Hathras after Gautam Buddha's mother Mahamaya. Once a sub-divison of Aligarh, Mahamaya Nagar was also declared a new district. However, in 1998 when the BJP-led government came to power, the town was rechristened as Hathras. In 2002, though, when Mayawati returned to the CM's chair, Hathras again became Mahamaya Nagar.

This was not the end of Hathras' change in identity. In 2003, when Samajwadi Party came to power, chief Minister Mulayam Singh Yadav renamed Mahamaya Nagar to Hathras. Not to be defeated easily, Mayawati, after she regained power in 2007, changed the name of the town for the fifth time in a decade. Former Advocate General, Uttar Pradesh SMA Kazmi, said: In instances where a new administrative unit has been formed or an existing one had been renamed, the old name goes along with a now named as'' tag, for easy identification. Within the country or region, this may not pose problems; travelling abroad, however, could be troublesome. It is advisable, however, for people to have their documents, like ration cards or passports, updated under such circumstances.''

The process to update'' such legal documents, though simply on paper, is not easily accomplished. Businessman by profession and a resident of Mahamaya Nagar, Sanjay Yadav, said: "My learner's licenxe was issued in late 1997 when the state was called Mahamaya Nagar. In the address space, the district was called Mahamaya Nagar Hathras. The next year Mulayam Singh changed the name of the district. When I went to get my permanent licence, the officer there made me run around to get proof that the district was now only Hathras, without Mahamaya Nagar. I had to pay him an additional amount to get the licence.''

Constitutional experts, however, say there's a process in place when it comes to the formation of a new or renaming of an existing district. Legal documents issued before carving out a district, or before rechristening an existing one, are typically acceptable when accompanied by a note that clarifies the new status of the administrative unit. Travelling to a country like the USA, however, could pose a problem, though, because they are extremely particular about the paper work,'' Kazmi added.

Also, merely announcing the formation of a district is not enough. A new administrative unit becomes a legal entity only after a formal gazette notification is published. It is true that the state government exercises the right to form or disband an administrative unit. However, it should follow a proper process, which includes a feasibility survey that explains the need for the unit. In UP, however, most districts have been formed for political reasons and without the due diligence.''

http://timesofindia.indiatimes.com/city/lucknow/Name-game-and-its-after-effects/articleshow/10193945.cms

1 OCT, 2011, 04.30AM IST, ET BUREAU

Instruments with sell-back options won't count as FDI

RELATED ARTICLES

- Realty FDI curbs not to be imposed on colleges, old-age homes

- FDI deals should not come with any strings attached: RBI

- Cabinet note soon on allowing 51% FDI in multi-brand retail

- Possible flood of Chinese goods holds up FDI in retail

- Committee of secretaries clears proposal to allow FDI in multi-brand retail

NEW DELHI: The government on Friday amendedforeign direct investment rules keeping all instruments with in-built options, such as right to sell back shares, out of FDI ambit.

This will hit the private equity industry the most and also affect capital inflows in general by making it difficult for investors to exit.

The new policy issued by the Department of Industrial Policy and Promotion (DIPP) on Friday imposes an additional condition on FDI in single-brand retail, saying that the investor must also own the brand.

"Only equity shares, fully, compulsorily and mandatorily convertible debentures and fully, compulsorily and mandatorily convertible preference shares, with no in-built options of any type, would qualify as eligible instruments for FDI," the policy says.

The DIPP updates its master policy every six months (April 1 and October 1).

H Jayesh, Founder Partner at law firm Juris Corp, said the government has given in to the RBI without realising that there is a 50-year old circular that permits options pursuant to JV agreements, including financial collaborations.

For years, offshore financial and strategic investors have struck deals with their Indian partners to put in place an easy exit arrangement. It gave the overseas investor the right to sell back equity shares to the promoter of the Indian company. The understanding between the two partners helped closely-held Indian firms attract overseas financial and strategic investors who, in turn, derived comfort from the arrangement

The FDI policy now says that such instruments, even if they have in-built options provided by third parties, will be considered debt instruments that will have to comply with the external commercial borrowing guidelines.

The restrictions on 'options' come after the Reserve Bank of India questioned many deals saying these inflows were more like debt than equity.

But policymakers think that with in-built options FDI investments lose their equity character, and the basic aim of the FDI policy to attract long-term equity funds is defeated as options are usually designed to provide exit.